Just What Is Usually A Funds Advance Upon A Credit Score Card?

March 13, 2025

Linking your Money Application plus MoneyLion accounts will aid an individual transfer funds in between them. You may likewise manually include your own Funds Application to your current RoarMoney account due to the fact it will job together with Money App. A Person furthermore acquire a free MoneyLion debit card any time an individual indication up for RoarMoney.

- Bills you hold together with nbkc bank, which includes but not limited in purchase to amounts held within Enable balances, usually are covered by insurance upward in purchase to $250,500 by implies of nbkc lender, Fellow Member FDIC.

- More significantly, though, Money App Borrow is usually not necessarily available in all UNITED STATES OF AMERICA says.

- MoneyLion provides no-fee cash improvements upwards to $500, dependent upon your own immediate downpayment activity plus the particular providers an individual signal upwards for.

Exactly How In Purchase To Include Funds To End Up Being Capable To Funds Application

Empower Economic stands apart with its robust cost management tools, including typically the AutoSave function of which aids within creating cost savings. Whilst providing improvements upwards to $250, users face a potential two-day wait regarding fee-free purchases, and weekend help borrow cash app restrictions emphasize its customer care nuances. Overview the conditions in addition to problems prior to accepting funds advances coming from a great software.

Brigit Cash Advance Application Powerplant

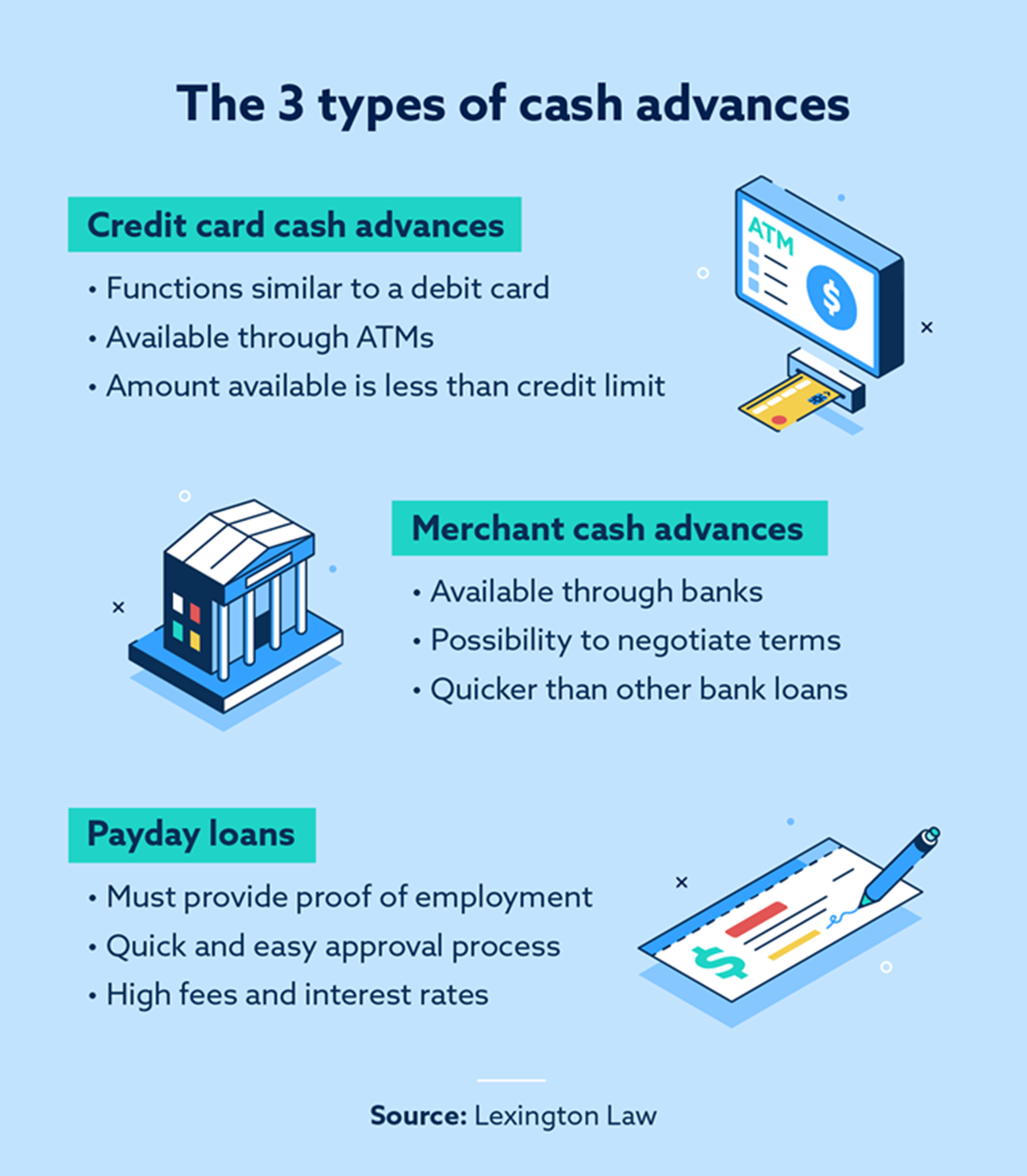

The Particular amount you can take like a credit score credit card cash advance may depend upon your cards issuer’s cash advance limits. You may typically locate your limit simply by looking at your card’s conditions or examining your credit score card assertion. If you’ve utilized all of your current accessible credit upon acquisitions, a person may possibly not really become capable to become capable to get away a cash advance even if an individual haven’t reached your current funds advance restrict.

Need To I Consolidate My Debts Into A Private Loan?

Overall, I would suggest Present over typically the additional programs on this checklist due to their BBB accreditation in add-on to lack associated with a membership charge in buy to access advances. Current’s banking choices are well worth contemplating, yet I would certainly steer very clear of their crypto investment. Crypto will be inherently high-risk, and when you’re occasionally approaching up brief among your current paychecks, it’s not the particular correct time to be capable to commit within anything like crypto. A better method would certainly be in order to function on building up a good emergency fund. When your crisis is usually a one-time thing plus the particular sum is usually little, consider asking someone close up to end upwards being capable to you in case an individual can borrow the cash.

- To Become In A Position To request a repayment expansion, choose the extend repayment choice within the particular application plus choose a day that will functions for you.

- The funds will become settled, or compensated back again, from your lender account once your current next paycheck visits.

- If an individual don’t pay off your current financial loan by typically the deadline—you acquire a grace period of time regarding 1 few days to acquire your current act together.

- To create your current search easier, we’ve put together a listing of noteworthy funds advance applications, including typically the advance sum a person can expect to borrow, costs, plus turn-around times regarding each and every application.

A Person might be in a position to become in a position to modify your card’s funds advance reduce or deactivate the particular cash advance choice altogether. Discover the proper credit rating cards by examining when you’re entitled prior to an individual utilize. Withdrawn coming from your current bank accounts on the day Brigit determines in purchase to be your own following payday. A well-rated cash advance app with several techniques to become in a position to make contact with customer care associates and a complete FREQUENTLY ASKED QUESTIONS about its web site will carry out well within this specific category. MoneyLion disperses advances inside increments up to $100, plus all those without having an active MoneyLion examining bank account usually hold out two to five times to acquire their cash. Possibly the best option to be able to a comparatively little money advance is temporarily increasing your income.

Unless you really like the particular thought of earning details, I’d move together with Existing or Cleo over Klover. Bills you hold with nbkc lender, including but not limited to bills held within Encourage accounts, are covered by insurance upward to $250,1000 through nbkc financial institution, Fellow Member FDIC. Thoughts portrayed inside our posts are usually solely individuals of the particular article writer. The Particular info regarding any type of item has been individually gathered plus was not necessarily supplied nor examined by simply typically the business or issuer.

Greatest For Simply No Fees

Vola Financing offers a selection associated with helpful resources in buy to aid you along with cash supervision. With Respect To example, a person may use spending stats to track your expenses and recognize areas where an individual could reduce back again. This Particular can end upwards being specifically beneficial in case you’re seeking in buy to conserve money or pay away debt. Additionally, Vola Financial gives a financing blog site complete regarding beneficial suggestions in addition to guidance about a broad variety associated with economic topics. Whether Or Not an individual would like to improve your current credit rating score or understand a great deal more regarding trading, you’ll discover a lot associated with beneficial info upon the particular Vola Financial blog site.

Just How Much Does A Super Funds Advance Cost?

Together With no curiosity or account costs, consumers profit through extra banking features plus wide-spread CREDIT entry. Enable will immediately offer a person anywhere coming from $10 to end up being in a position to $350 inside cash along with zero interest or late costs. After a 14-day free of charge test, Encourage deducts a great $8 membership fee coming from your own looking at accounts each calendar month. In Case you’re contemplating using cash advance applications compatible with PayPal, weigh the advantages in inclusion to cons.